When did lending and loaning begin? We all know the basic gist – for your grains, you receive my cotton – but let’s have a quick walkthrough, understand the history of credit loan, and explore the threads of innovation, risk, and societal transformation.

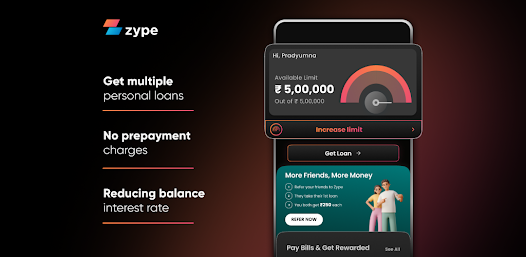

Of course, life is a lot easier now with various platforms and applications that make the process of getting a loan simple and convenient. With just a click, you can get an instant personal loan online and manage your money seamlessly without even ever needing to talk to someone!

- Mesopotamia, not just a funky word –

The roots and origin of lending can be traced all the way back to ancient civilizations, such as Mesopotamia, where merchants lent food, tools, and other goods to farmers and traders. In ancient Greece and Rome, wealthy individuals provided instant credit to finance their trade ventures and agricultural projects – eventually laying the foundation for our modern banking practices.

- High-interest rates –

When money lending became a common act, lenders started charging an interest rate high enough to astonish the Catholic Church as well. During the Middle Ages in Europe, the Catholic Church banned the charging of excessive interest. Even the famous philosopher Aristotle condemned the act; however, money lending continued to grow.

- The rise of medieval banking –

As European commerce expanded (slowly, almost taking over the world), banking practices started taking root. Wealthy merchant families like the Medicis in Italy provided loans to kings and nobles, financing the Renaissance. This led to the emergence of the Medici Bank, which facilitated trade and provided credit to members in need.

- Industrial Revolution –

We’ve all studied this chapter in our history books, right? Industrial Revolution – the era of rapid technological innovation and economic growth. The period of change from an agrarian economy to one dominated by industry and machine manufacturing. Industrialists and entrepreneurs turned to banks and financial markets to secure capital for building factories, railways, and infrastructure, fueling the expansion of industrial economies and, you guessed it, more banks!

- The 20th century –

An inspiring as well as testing time, the 20th century witnessed the rise of modern banking systems characterized by central banks, commercial banks, and regulatory frameworks. But with the progress came the trouble – the Great Depression and subsequent financial crisis spurred the creation of the Federal Reserve System in the United States, along with other banking reforms and institutions.

- Globalization and innovation –

The rise of multinational companies, international trade, and electronic banking revolutionized lending practices, making it easier to access credit and manage finances across borders. In the latter half of the 20th century, globalization and technological advancements transformed the financial landscape.

- Credit cards! –

Hate them, Love them – you know you always have them. Credit cards, pioneered by the Bank of America in 1958, increased convenience and accessibility. As consumer credit rose rapidly, so did competition among lenders that fueled the development of mortgages, online loan app, and small business financing.

From ancient civilizations to the digital age, instant loan India has been a catalyst for progress and prosperity. As we navigate the complexities of the modern economy, let us draw upon the lessons of the past to build a more equitable and sustainable financial future for all.

Leave a Reply