In today’s landscape individuals are seeking a user friendly personal loan apps India that empowers them to effectively manage their finances. This guide dives into the cool features and advantages of unique apps that’s more than just a loan service. It’s made to make your financial life better in every way.

Understanding the App’s Roots:

These loan apps in India are proud of their origins showcasing a dedication to fostering innovation and offering financial solutions that prioritize the needs of users. The developers have taken consideration of the obstacles faced by individuals in India aiming to deliver a smooth and inclusive experience, for managing money.

Fair Practices in Financial Solutions:

One of the standout features of these apps are its unwavering commitment to fair practices in the financial sector. From insta loan services to transparent lending terms, these apps uphold a set of principles that prioritize the financial well-being of its users. This commitment to fairness sets it apart in an industry where trust is paramount.

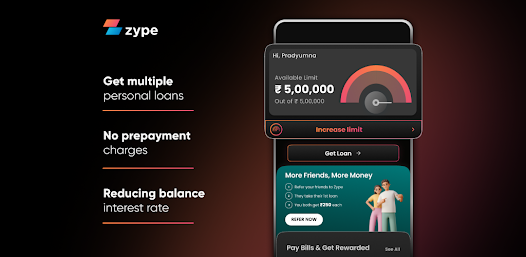

Activating Your Credit Line:

Unlocking the potential of a small loan app begins with activating your credit line. The system is designed to be simple and user friendly allowing individuals, from all backgrounds to effortlessly access the assistance they require. A clear and concise set of instructions streamlines the activation process making it accessible for those who’re not familiar with digital financial tools.

Smart Money Insights:

At the heart of these applications lies its Smart Money Insights feature, a powerful tool that transforms online money management. By providing users with intelligent financial data and personalized insights, these apps empower individuals to make informed decisions about their finances. From budgeting tips to investment suggestions, these insights make financial planning more accessible and less daunting.

Diverse Features Beyond Lending:

While lending is a core function, easy loan app goes above and beyond expectations by offering a range of diverse features. Users can explore tools for expense tracking, investment planning, and even access educational resources on financial literacy. These applications are like a hub for individuals seeking to expand their knowledge on money management and wise decision making. It goes beyond providing loans and encompasses a range of financial topics making it an excellent resource for enhancing your financial literacy and making informed choices with certainty.

Empowering Your Finances:

In today’s world, where financial tools are prevalent, these apps, developed in India, stand apart by integrating an understanding of Indian financial habits and requirements. By offering solutions that align with the approach to money management these apps go beyond being a tool—it becomes a trusted companion, throughout one’s financial journey.

Seamless Online Loans:

These apps provide a loan procedure delivering a navigation experience that is user friendly and effective. Users can effortlessly acquire the funds, supported by suggestions to help them attain their financial objectives. The blend of simplicity and elegance positions these apps, as exceptional, in the realm of management.

Wrapping Up:

In the realm of online money management, the Made in India app emerges not just as a solution but as a guide—a partner in navigating the complexities of personal finance. Its commitment to fair practices, user-friendly features, and a holistic approach to financial well-being make it a beacon of financial empowerment. As individuals seek an effortless way to manage their money online, these apps stand tall, offering a comprehensive and intuitive solution that goes beyond the conventional boundaries of financial tools. Embrace the ease, empower your finances, and navigate your financial future with confidence.

Leave a Reply